Traditional investment avenues like stocks, bonds, and real estate are becoming increasingly saturated, so investors are looking for other opportunities that offer potentially high returns. Here’s a countdown of the top 10 non-standard investment ideas for this year. For each category you will see an overall rating from 1 to 10 with 10 being the easiest to start with taking into account all of the previous factors mentioned such as capital needed, potential return on investment, risk involved and difficulty.

Idea 10. Investment in Wines

Capital needed: Medium

Potential return on investment: Medium

Timeframe to see profits: Medium

Risk involved: Medium

Difficulty: Hard

Overall rating: 7.0 out of 10

Investing in fine wine has become a popular choice for those looking to diversify their portfolio. High-quality wines tend to appreciate in value over time, especially vintage bottles from renowned vineyards. However, this investment requires significant knowledge about the wine market and proper storage conditions to maintain the value of the bottles. This is one of the most unusual suggestions we have, however you might consider it depending on your current circumstances.

Idea 9. Domain Names

Capital needed: Low to Medium

Potential return on investment: Big

Timeframe to see profits: Medium to Long

Risk involved: High

Difficulty: Medium

Overall rating: 7.5 out of 10

Domain name flipping can be highly profitable if you can secure domains that might become valuable in the future. It’s a speculative market, with high risks but also potentially large rewards if you manage to sell a domain to a high-demand buyer. Buying and selling sites for profit can be harder. When it comes to domain names, you just have to secure a good domain name with a high potential and wait for the sellers to come.

Idea 8. Intellectual Property (IP) Rights

Capital needed: High

Potential return on investment: Big

Timeframe to see profits: Long

Risk involved: High

Difficulty: Hard

Overall rating: 5.0 out of 10

Buying IP rights, such as patents, trademarks, or copyrights, can yield substantial returns if the intellectual property becomes commercially successful. This investment requires a deep understanding of the market and potential legal complexities, making it a high-risk but high-reward opportunity.

Idea 7. Farmland

Capital needed: High

Potential return on investment: Medium

Timeframe to see profits: Long

Risk involved: Medium

Difficulty: Hard

Overall rating: 5.5 out of 10

Investing in farmland can be lucrative due to the increasing global demand for food. Farmland can appreciate in value and also provide income through leasing to farmers. However, this requires a substantial capital investment and knowledge of agricultural trends and land management.

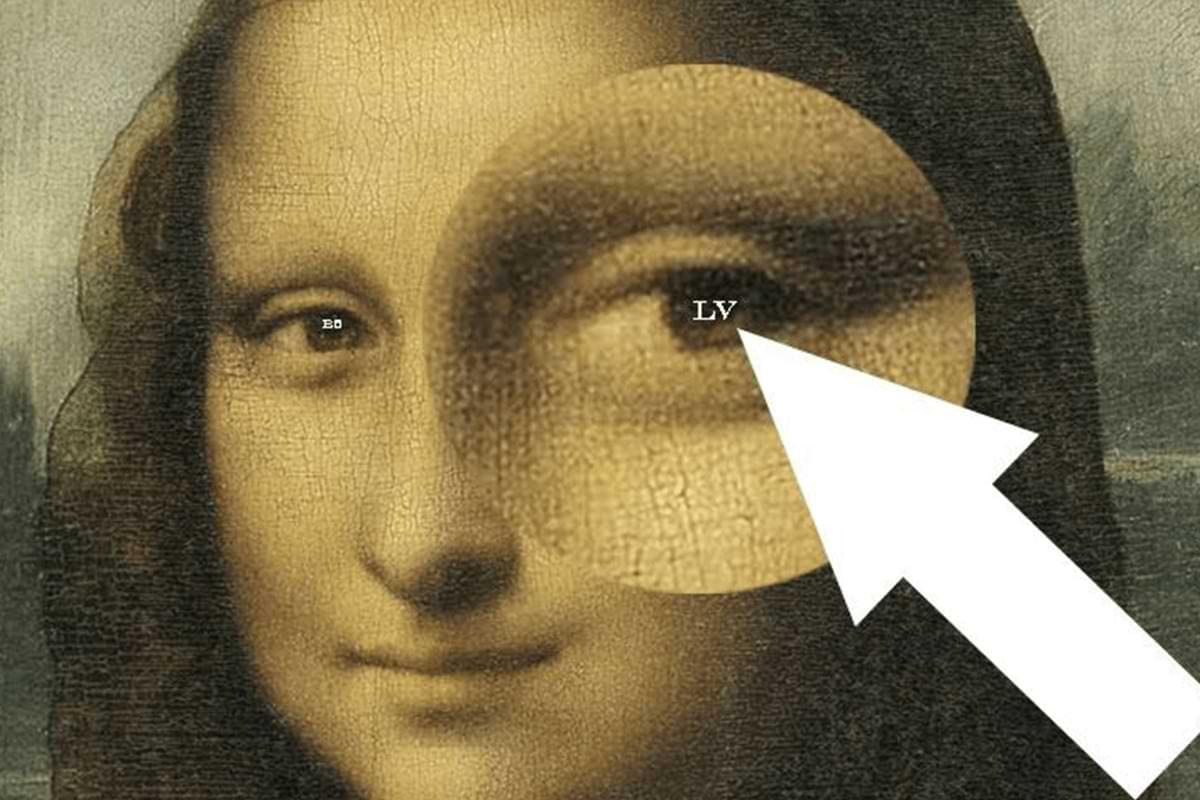

Idea 6. Art

Capital needed: High

Potential return on investment: Big

Timeframe to see profits: Long

Risk involved: High

Difficulty: Hard

Overall rating: 7.0 out of 10

Investing in fine art can be highly rewarding, with some pieces appreciating significantly over time. However, the art market can be volatile and requires a discerning eye and expertise to select the right pieces. Additionally, art must be properly insured and stored.

Idea 5. Collectibles (e.g., Coins, Stamps)

Capital needed: Medium

Potential return on investment: Medium

Timeframe to see profits: Medium

Risk involved: Medium

Difficulty: Medium

Overall rating: 8.5 out of 10

Collectibles like rare coins and stamps can be valuable assets that appreciate over time. This investment combines the pleasure of collecting with the potential for financial gain. The key is thorough research and verification of authenticity.

Idea 4. Cryptocurrencies

Capital needed: Medium

Potential return on investment: Big

Timeframe to see profits: Short to medium

Risk involved: High

Difficulty: Medium

Overall rating: 8.0 out of 10

Cryptocurrencies continue to offer significant investment opportunities, though the market remains highly volatile. Understanding blockchain technology and market trends is crucial. Despite the risks, many investors have seen substantial returns on their investments in this sector.

Idea 3. Peer-to-Peer Lending

Capital needed: Low

Potential return on investment: Low

Timeframe to see profits: Medium

Risk involved: Medium

Difficulty: Easy

Overall rating: 8.7 out of 10

Peer-to-peer lending platforms allow investors to lend money directly to individuals or small businesses in exchange for interest payments. This can provide a steady stream of income, though the risk of borrower default must be considered. The downside is the low to medium return on investment with 10% yearly return being the industry standard.

Idea 2. Renewable Energy

Capital needed: High

Potential return on investment: Big

Timeframe to see profits: Medium

Risk involved: Medium

Difficulty: Medium

Overall rating: 6.5 out of 10

Investing in renewable energy, such as solar or wind farms, is both a financially and environmentally sound decision. With governments and corporations pushing for greener solutions, this sector is poised for significant growth, offering substantial returns on investment.

Idea 1. Automated Trading Platforms

Capital needed: Low

Potential return on investment: Big

Timeframe to see profits: Short to Medium

Risk involved: Medium

Difficulty: Medium

Overall rating: 9.5 out of 10

Automated trading platforms use algorithms and AI to trade assets like stocks, forex, and cryptocurrencies. These platforms can execute trades much faster and more efficiently than human traders, potentially leading to higher returns. While there are risks involved, particularly related to market volatility and technical issues, the potential for substantial gains makes this a top investment choice. Automated trading requires some initial setup and monitoring but offers a promising blend of profitability and convenience.

In conclusion, these non-standard investment opportunities offer a variety of options for those looking to diversify their portfolios. Each has its own set of challenges and rewards, so thorough research and careful consideration are essential.